MTS Repo

The trusted home of repo trading for over 25 years

The MTS Repo platform is an order driven market delivering deep liquidity for both cash investors and specific bond traders across Europe with fully automated settlement and connectivity to clearing houses.

With over 100 unique participants and liquidity across all eurozone markets, MTS Repo is a benchmark electronic trading platform for European repo.

Order book trading of repurchase agreements and buy/ sellbacks sits alongside Request for Quote (RFQ) and a dedicated OTC Trade Registration mechanism to offer maximum choice when executing on the MMF (Money Market Facility) platform.

MTS BondVision Repo completes the money market offering by giving buy-side clients RFQ access to a large pool of dealers as well as to axes and interdealer market data.

Optimal coverage and liquidity

- Reference portfolio of specific bonds and GC baskets

- Eurozone government bonds and Gilts

- Tri-party repo baskets, including €GC Plus

Exceptional trading capabilities

- Click-to-trade and request for quote

- Dedicated Trade Registration mechanism

- Credit line management and intra-day credit controls

Trusted and secure

- Fully regulated and compliant with prevailing and future regulations

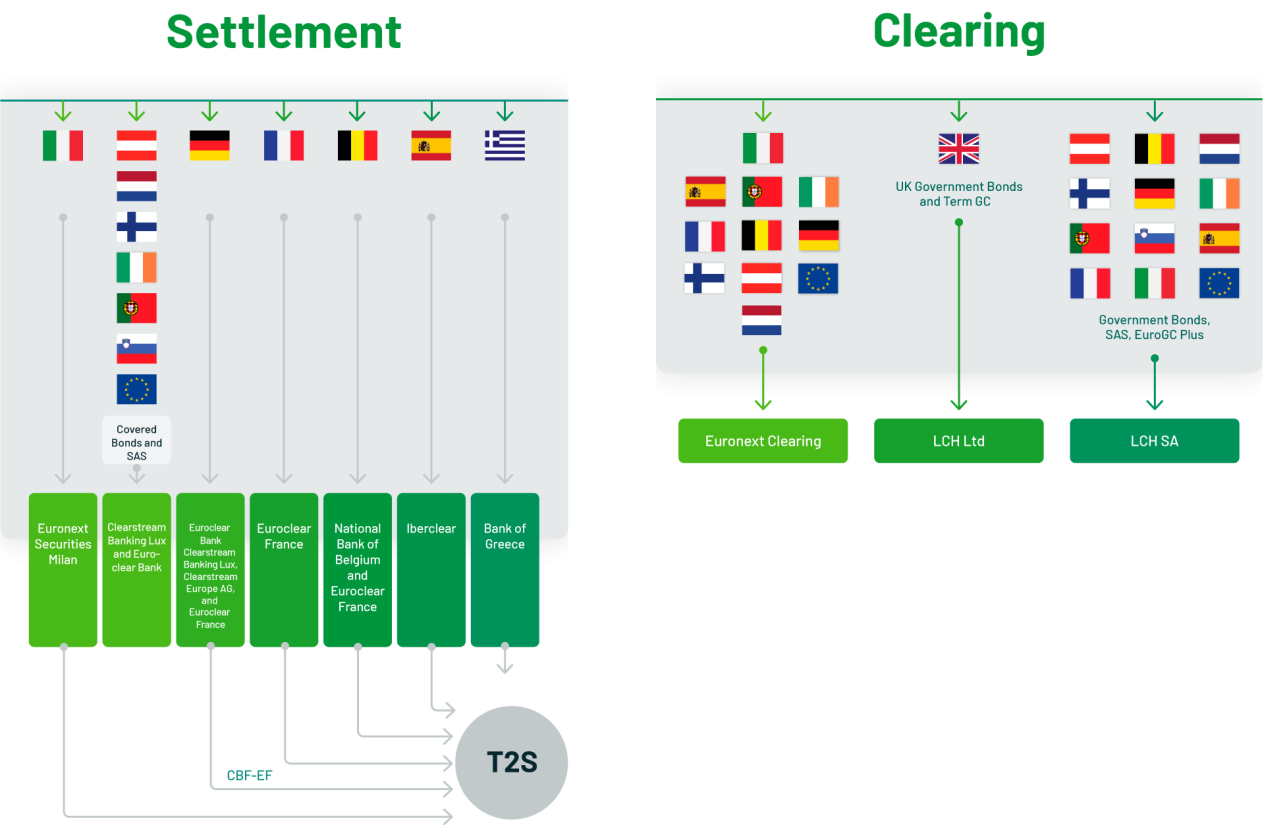

- Connectivity to all major European CSDs, ICSDs and clearing houses

Straight-through processing

- Settlement instructions automatically created and sent in real-time

- Message copies can be sent to custodian banks for reconciliation purposes

- Instructions auto-matched, eliminating potential post trade discrepancies

Leading technology

- Open architecture with support for API and ISV connectivity

- Customisable and freely distributed reference GUI

- Leased line or industry secure internet connectivity

Trading community

- Access liquidity from over 100 unique trading entities

- From tier one global down to local regional banks

- Central bank, DMO and quasi-government organisations all active

Repo markets

Tri-party repo

A secured tri-party transaction helps to efficiently limit risk exposure, increase returns and optimise balance sheet usage.

MTS supports the tri-party services of Euroclear and Clearstream, facilitating repo trading in both bilateral and cleared tri-party products:

- €GC Plus – LCR, ECB, GovSSA, Green & country specific baskets supported by Euroclear tri-party services and cleared by LCH SA

Bespoke tri-party baskets on MTS BondVision Repo, enabling dealers and clients to trade established baskets electronically

Post-trade clearing

MTS Repo is connected to all relevant domestic and international settlement systems, central clearing houses and tri-party agents, allowing automatic registration of trades and seamless STP integration.

This can help reduce booking errors, cancellations and other issues that have an effect on efficiency and profitability, whilst reducing the costs typically associated with manual booking of trades.

Full details of our post-trade network can be found below.

SFTR Blotter

MTS helps the buyside and sellside to comply with reporting obligations by providing the SFTR Blotter. Trades executed on MTS Repo are provided in the SFTR fields and formats, allowing firms to quickly report the necessary information to their chosen Trade Repository.