MTS Cash: Domestic Bond Markets

Leading Europe's bond trading

MTS Cash is the leading platform in Europe for electronic dealer-to-dealer (D2D) European Government Bonds (EGBs). As a fixed income market operator, we work closely with debt management offices (DMOs), primary dealers, regulators, and central banks across Europe and beyond to facilitate highly liquid primary and secondary bond markets.

MTS Cash supports a liquid, transparent, and efficient European bond marketplace, hosting a large interdealer network, offering innovative technology, comprehensive support, and wide product coverage.

Efficient trading platform

Professional, efficient and orderly market supported by cutting-edge technology

Central limit order book

Fully transparent order book with real-time executable pricing

Wide product coverage

Expanding choice of tradable securities includes fixed coupons, floating coupons, zero coupons and index linked coupons

Open technology architecture

Seamless integration with pre-trade and post-trade applications

Secondary market functionalities

Rich functionality includes central limit order book, mid-price crossing and trade registration

Primary market functionalities

MTS Cash also supports primary auctions, switch auctions, taps and buy-backs

Click here for Issuer Services

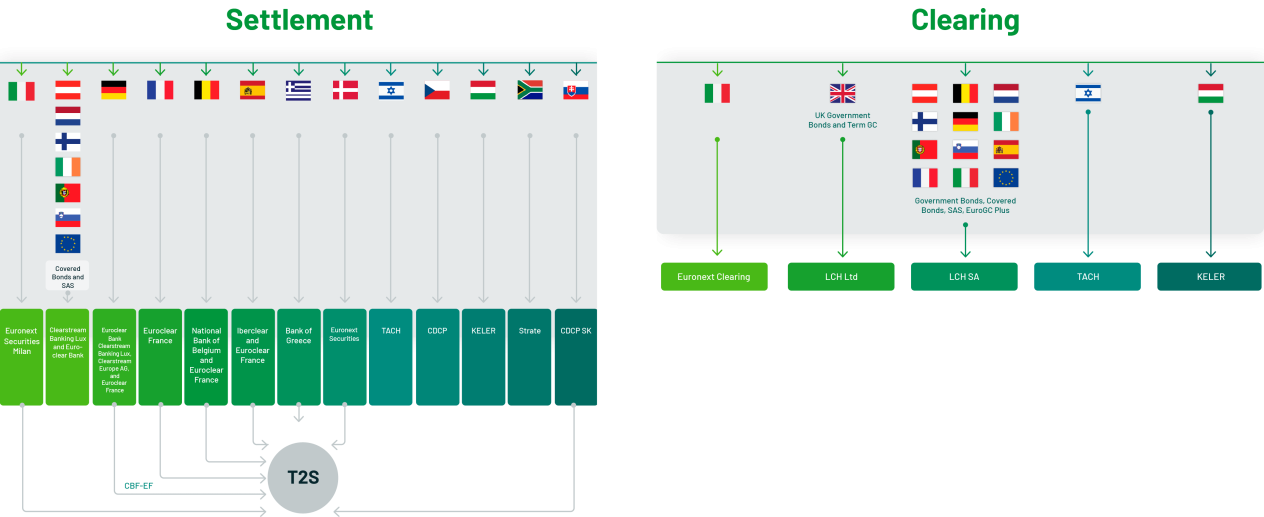

Complete automated settlement network

Links to all major European central securities depositories (CSDs) and central counterparties (CCPs)

Domestic bond markets

Trading functionality

Central limit order book

- Fully transparent order book with real-time executable pricing

- Auto-matching of quotes of opposite side subject to limit price

- Iceberg functionality allows users to work larger orders in the order book with a split between visible and hidden order quantities

- Low network latency and deep order book promotes rapid execution, even for block-size orders

- Users with membership of both the Domestic and E-Bond Market (EBM) can efficiently provide and access liquidity from both order books

MTS MidPrice

- Dedicated functionality for matching opposite interests at mid-price, continuously available throughout the trading day

- Mid-price sourced in real-time from either BV Composite or the MTS Cash order book

- Users can set limit price and minimum executable size on mid-price orders

Trade Registration

- Dedicated functionality for executing pre-arranged trades on MTS Cash

- Counterparties can confirm their pre-arranged trades and benefit from MTS Cash's STP

Market model

- The domestic market is the quote-driven order book tailored to the fulfilment of primary dealer quoting requirements

- The E-Bond Market (EBM) is the order-driven natural interest order book that acts as an additional source of secondary market liquidity to eligible secondary market participants

Technological innovation

Scalability: the structure of the MTS Cash platform allows for new markets and bonds to be added easily, allowing it to grow with the market

Capacity: As markets have evolved with the introduction of new instruments and structures, the MTS Cash platform has remained robust and reliable

Performance: the average round trip time of transactions is currently 0.249 milliseconds

Connectivity: members can integrate their pre-trade and post-trade applications with MTS Cash via the native SDP protocol, with FIX available for trade capture

MTS MultiProduct GUI: members can use a single GUI to access MTS Cash, BondVision and BondVision Repo

Post-trade straight through processing

MTS automatically submits settlement instructions for trades to the relevant CCP or CSD/ICSD

- Eliminates any potential post-trade discrepancies, mismatching errors and fails

- Reduces manual post-trade clearing and settlement processes

- Drop copies available for custodians for reconciliation purposes