MTS Data Products

Unlock unparalleled market insights with MTS Data

MTS offers a range of enhanced data products, from historical and end-of-day data to real-time and ultra-low latency feeds. Sourced directly from MTS OrderBooks, the leading platform in Europe for Dealer-to-Dealer (D2D) European Government Bonds (EGBs), our data captures a significant portion of electronic D2D EGB trading volumes.

As a market data provider, we offer:

- Non-commoditised data

- High-quality data

- Back-testing data

- On-demand support

- A flexible and transparent relationship

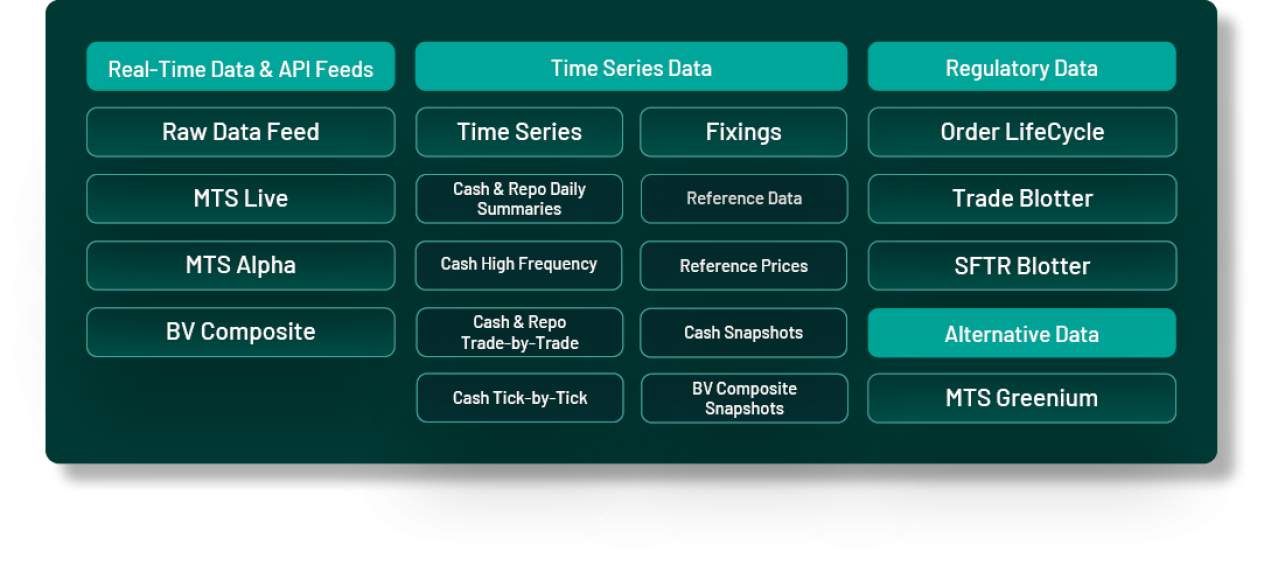

MTS continuously innovates to deliver specialised data services, catering to the unique strategies of market participants with offerings such as real-time feeds and APIs, time series data, and regulatory data.

Learn more about MTS Data products

Real-Time Data & API Feeds

Access executable and indicative prices directly from the source

Click here to learn more

Time Series Data

Optimise research capabilities and develop strategies in a dynamic trading environment

Click here to learn more

Regulatory Data

Empower regulatory compliance with innovative data solutions

Click here to learn more

Alternative Data

Harness real, executable data on green and conventional bonds

Click here to learn more